How Fashion Retail Has Survived The Covid-19 Pandemic

Over the last 10 months, we have followed all of the newsletters on fashion retail, fashion production, ethics in fashion, sustainability initiatives and innovations... quite overwhelming in fact. In this three-part blog series, we collate all of the articles into bitesize chunks of information, giving you - as both consumers and business owners - insight in to the impact the pandemic has had on fashion retail, in line with our Masterclass on Survival Strategies.

Part one here explores online shopping. Part two will look at the high street. And part three is all about wellbeing in business.

Online shopping

The figures are confusing, as they tend not to differentiate between online and offline sales. But here we pinpoint some of the key articles.

Comfort and convenience

Comfort clothing was the biggest best seller online over the lockdown period March to September 2020. November would normally see partywear and work attire spike in sales, but this time, shoppers stuck with convenience [Fashion United].

In September, even though the country was out of lockdown restrictions, physical stores were not yet recuperating, with most funds being spent on non-clothing items amidst fears of further restrictions [The Industry]. There was a spike in sales from previous months but clothing sales were down 12.7% in September from February [Fashion Roundtable].

Fast fashion still on top

Consumers are sticking with the "reliables", with sales for Ted Baker and Ralph Lauren sticking. And yet, clothing sales in April overall still rose 22% from the same time in 2016, with people shopping out of boredom.

Even the fast-growing fast fashion giants have had a mixed year. In its yearly report, released on 14 October, Asos reported a 329 per cent rise in pre-tax profits, driven by a 19.3 per cent increase in sales across the UK, US and the EU. At the same time, however, the company's gross margin fell, as did its share price, with the cost of selling clothes rising and the economic prospects of customers uncertain. ~ [New Statesman]

Posting surges, with people either unable to get to shops early, not wanting to queue, or will be unable to see certain family members and friends [The Industry].

With news this week that Arcadia have gone into administration, this article from Retail Dive wasn't quite right, and yet it shows how most of the '17 brands that could go bankrupt' listed here are apparel.

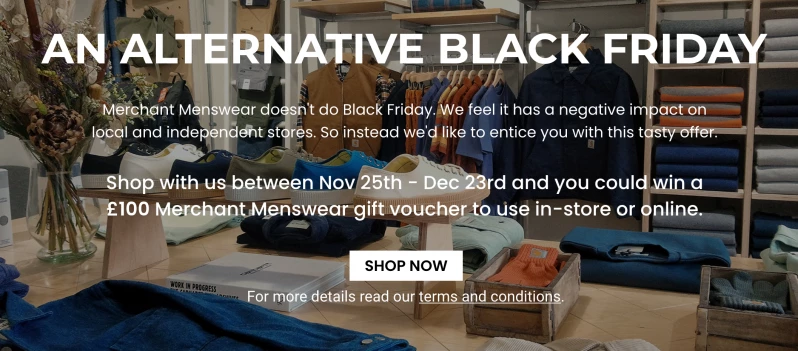

Brands were pushing the Black Friday sales as normal to regain their income. However, sustainable fashion brands were set in their ways to be as honest as possible with their marketing strategy, hosting alternative methods of customer capture such as newsletter sign ups to win a gift card.

If you're looking for guidance on how to approach promotions for your product business, listen to The Resilient Retail Club's Podcast Episode 15.

As Lockdown 2.0 eased across England on 2nd December, queues were forming on Oxford Street [The Industry], but it is still seen as a Darwin moment where those who cannot shift overstock are losing out custom and being forced to close [Fast Company].

Buy-Now-Pay-Later

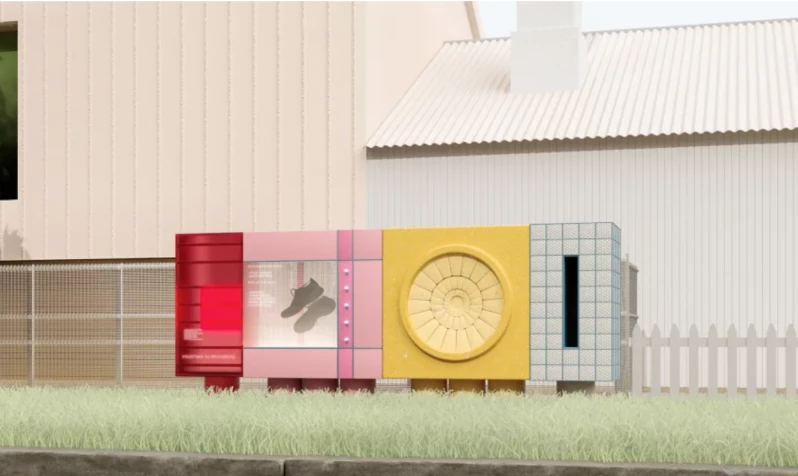

Klarna launched a widget that would allow consumers to stay on top of the latest deals [The Industry]. They also want to introduce stylish lockers that online shoppers can use for their deliveries [Fast Company].

Clearpay has been adding even more brands on to its roster [The Industry].

"New research prepared by Capgemini, surveying more than 850 retailers across the U.K., U.S., Germany, France, the Netherlands and Scandinavia, shows that 46% expect to see increased holiday sales this year. More specifically, retailers are expecting to see online sales as a key driver of this festive season, with 93% of the retailers having taken steps to improve their online presence in anticipation." [Forbes]

Social media

As anyone who has watched Joy will know, televised sales channels will reach out to a particular audience, and with the right sales pitch, will fulfil their desires. Now, social media channels are set to increase that reach with live shopping videos on Instagram and TikTok making waves for luxury fashion brands [Vogue Business].

Many brands have decided to try virtual stores as a way to engage with customers. Augmented Reality try-ons or the stores themselves, and with yet another new iPhone that has AR capabilities, experiential e-commerce can continue the physical space in a restricted future [Vogue Business]. Or, does it signal even more privilege for those who can afford that way of shopping?

TikTok is now the seventh largest social media network, with 689 million active monthly users. Now, TikTok has partnered with Shopify to bring ability for sales through the app [The Industry].

By looking at their feeds, it is clear that fashion brands are stuck in the aspirational advertising model, i.e.: videos shot with models showing clothing as in a fashion showroom, and are struggling to adapt to TikTok’s language and spirit. ~ [Sportswear International]

Yet, human touch in the form of customer service has been shown to benefit in customer engagement and sales [McKinsey].

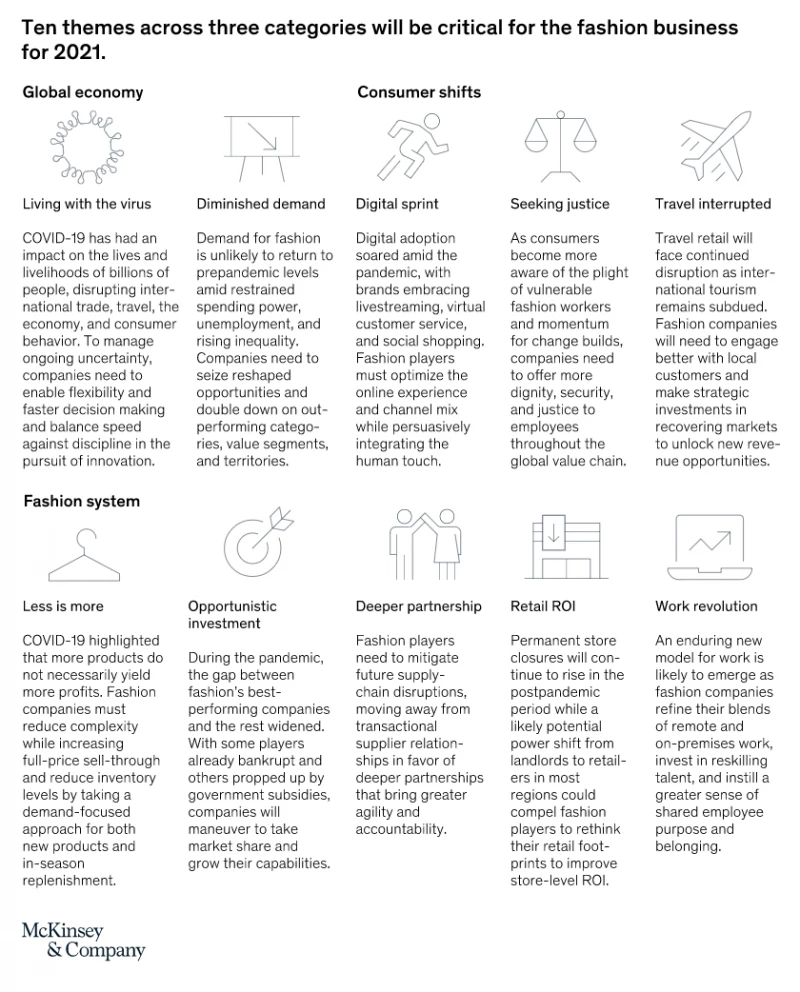

In another McKinsey report, 'The State Of Fashion 2021', they give details of the winners over this year e.g. those with a significant Asia market, and the top trends for 2021 that will be critical for fashion businesses to implement. See image below.

Fashion shows

Fashion shows are usually a place to raise the profile of a brand, to show that they're worth your attention, or because what they offer suits a certain customer. In line with trade shows and showrooms, there is now concern over running these events, so how will brands gain visibility to be bought? We hear from London, Paris and Milan frequently, even Berlin, but what about Africa? 'What Happened To Africa's Fashion Month?' [Vogue Business].

Environmental Issues

Return of goods

Online shopping inevitably causes an influx of returns, but now there is also the issue of quarantining. As inventory availability affects sales i.e. if your inventory is incorrect or something is taking a while to come back into stock, as a brand you want to ensure you get stock back out on to the floor or website ASAP [Fashion United]. With reports that returned goods are going to landfill [CBC], being incinerated or slashed rather than resold as we would imagine, it is a good time now to really consider what you're purchasing, and the affect on the small businesses you are purchasing on who have to deal with admin and costs of that.

This report from Raconteur talks about the changing retail calendar that will offer ease to customers, along with logistics companies - including self-employed ones - who need not deal with understanding a handheld device. Ultimately, the effect of having smaller pockets of retail sales should make it less restrained on postal and courier systems.

Ways to avoid returns though is another thing. Wouldn't it be great if what we bought just worked? Zyler, via Fashion United, have a few options that will increase user engagement while increasing user-generated content that you can have on your product pages to offer more information to prospective customers. It just makes sense - have better images, have reviews, have as much information as possible.

Scaling back

With the news of cancelled orders and garment workers being made redundant without compensation, the public hit back at brands demanding that they pay up. It forced other brands to consider their inventory - either due to delays, lack of materials or in understanding they didn't need to produce as much.

Mara Hoffman scaled back the operations by focussing on merchandising existing stock to sell it, and creating a smaller 2021 collection. They are also ensuring more regeneratively farmed materials, that also supports local communities.

Maggie Marilyn similarly stepped out saying that clothing doesn't devalue over time, and so were leaning in to the direct-to-consumer channels to retain the conversation. This also involved recently launching a range of lower priced basics that drew on the main brand's values, and while it could upset some existing customers, the implementation of the ongoing Somewhere collection has seen revenue increase [Fashionista].

Head to the Masterclass on Survival Strategies for Fashion Retail.